Credit

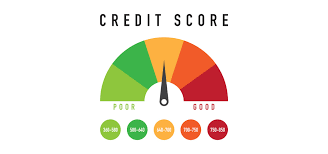

There are a variety of factors that contribute to your FICO score, but do you really understand what goes into creating your credit score? This course will remove myths about your credit score, encouraging you to repair and increase your score by consistently practicing some of the methods provided within this curriculum.

- 1191 Enrolled

- Created by Tameeka Colon

- Last updated 09/30/2021

-

Description

In the U.S., credit is your pipeline within the financial system. When you establish good credit, it is easier to do a lot of things like renting an apartment in a nice neighborhood, purchasing a home, buying a car for your family, starting a small business, and financing your child’s education.

Each chapter within this course will provide you with tools to use in effort to improve your credit score and financial management practices daily to reach your goals.

What you’ll learn

- FICO Score

- Credit Mix

- Credit Utilization

- Installment Loan

- Paying Off Your Credit Debt

- Length of Credit History

- Revolving Credit

- Alternative Credit Options for the Non-Traditional Consumer

Here is exactly what we cover in this course:

Over the course we'll review certain terms and credit repayment options to help you meet your financial goals. Of the topics featured include discussions about:

- What is credit?

- What is a credit score?

- Alternative credit options to improve your score

- Experian Boost and Ultrafico

- Secured credit cards

Notice

Subscribe to training to access content.